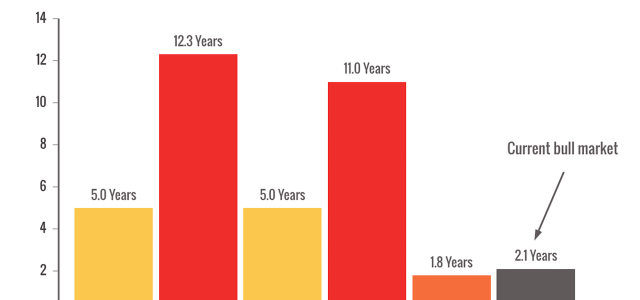

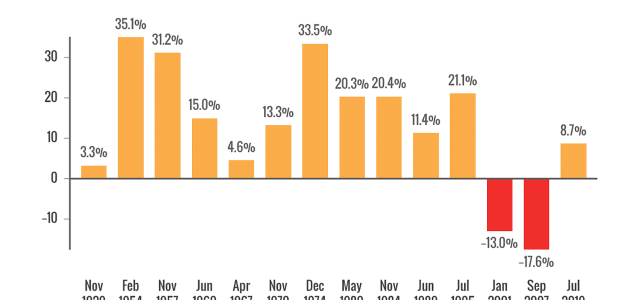

Markets have been on a roller coaster, and investors are asking: Is a bear market on the way?

Read More

It’s been hard to miss the wave of attention-grabbing headlines lately. News cycles have been dominated by concerns over Big Tech’s earnings, trade tensions

Read More

As we step into 2025, I thought it would be beneficial to take a moment and reflect on what an extraordinary year 2024 was for investors.

Read More

Now that the election is over, what will the new administration prioritize in the new year? Take a look at a few things we’re watching in the months ahead.

Read More

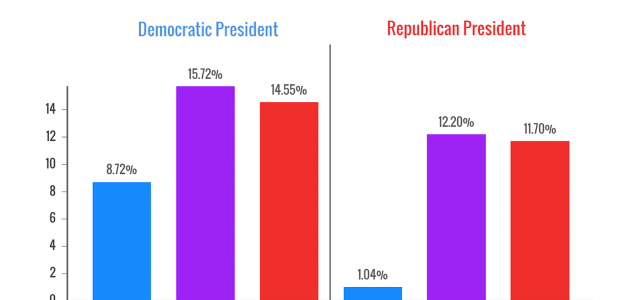

What do presidential elections mean for your portfolio?

Read More

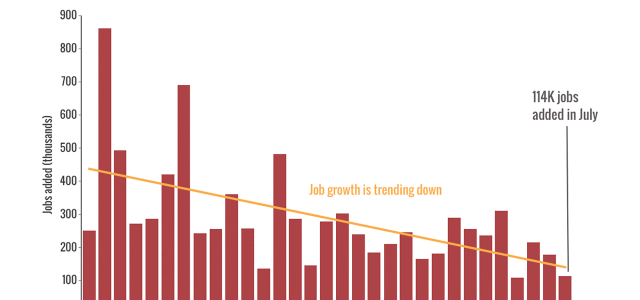

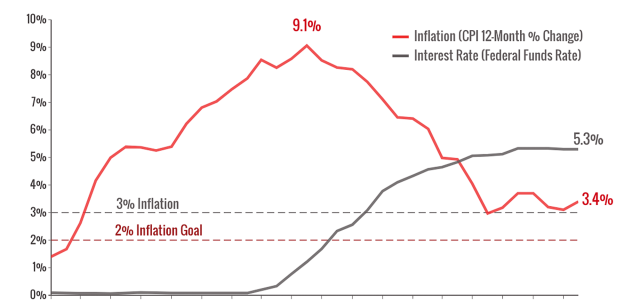

Why did the Federal Reserve cut rates? Learn more here.

Read More

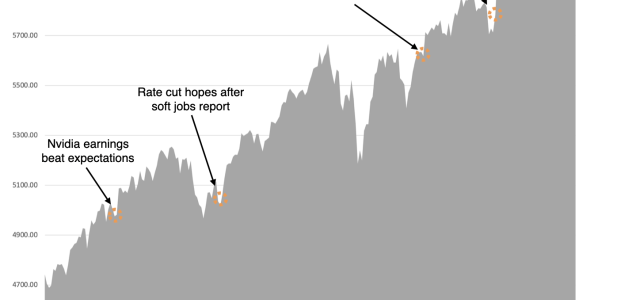

It’s been a wild August for markets. Let’s review.

Read More

A lot has happened recently. Let’s review.

Read More

How do you feel about the state of the economy? In more contemporary terms, what are your "vibes" telling you?

Read More

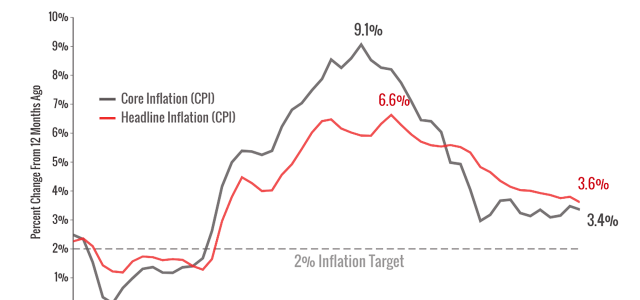

After months of simmering inflation reports, it looks like inflation finally eased slightly in April. Are prices stabilizing? Can we breathe a sigh of relief

Read More

Markets have been very volatile lately. What’s going on? Let’s take a quick look at the factors that are influencing markets right now.

Read More

As we kick off 2024, the latest data is raising some concerns about inflation. Let’s dive into some data and take a look.

Read More